When house hunting in Charlottesville, it’s easy to focus solely on the listing price and mortgage payments. However, successful homeowners know that budgeting for the hidden costs is what truly prepares you for homeownership. Let’s explore these often-overlooked expenses and how to plan for them effectively.

Understand Closing Costs Beyond the Down Payment

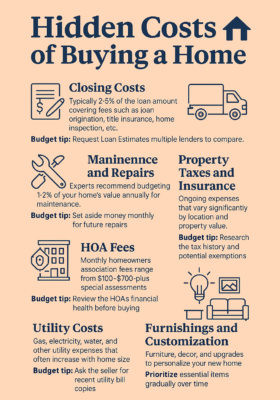

Closing costs typically range from 2% to 5% of your loan amount. These can include:

- Loan origination fees

- Title insurance

- Home inspection fees

- Appraisal fees

- Attorney fees

- Recording fees

- Property transfer taxes

Budget tip: Request a Loan Estimate from multiple lenders to compare closing costs. Some fees are negotiable, and sellers may be willing to cover a portion of them.

Don’t Overlook Moving Expenses

Whether hiring movers or renting a truck, moving costs can quickly add up, ranging from several hundred to several thousand dollars, depending on the distance, volume, and timing.

Budget tip: Get quotes from at least three moving companies early. Mid-month and mid-week moves tend to be cheaper.

Plan for Home Maintenance and Repairs

Ongoing maintenance is part of every homeowner’s reality. Experts recommend saving 1–3% of your home’s value annually for general repairs.

Budget tip: Establish a home maintenance fund and contribute to it monthly. A home warranty may help cover large systems, such as HVAC or plumbing.

Prepare for Charlottesville Property Taxes and Home Insurance

Property taxes and homeowners’ insurance are ongoing, and they often increase after you purchase a home, especially if the home was previously under-assessed.

Budget tip: Research the property’s tax history and ask your agent about homestead or veteran exemptions, if applicable.

Review HOA Fees and Special Assessments

If you’re buying into a condo or neighborhood with a Homeowners Association (HOA), you’ll likely pay monthly dues, and potentially special assessments for large repairs.

Budget tip: Request to review the HOA’s financial statements, reserve fund, and meeting minutes. Look for signs of upcoming projects or underfunded budgets.

Expect Higher Utility Bills Than You’re Used To

First-time homeowners are often surprised by the increased utility costs they encounter after moving from a rental property. Larger square footage, older appliances, or drafty windows can all contribute to increased energy use.

Budget tip: Ask sellers for their past utility bills and consider investing in energy-saving upgrades, such as insulation, LED lighting, or smart thermostats.

Budget for Furniture and Customization

Buying a home often means starting from scratch with furnishings. You’ll likely want to paint, add window treatments, and purchase essentials like beds, a dining set, and a washer/dryer.

Budget tip: Furnish room by room, prioritizing essentials first. Create a phased decorating plan to avoid draining your savings all at once.

Create a Personalized Homeownership Budget

Here’s how to build a realistic budget for your first year in the home:

- Research localized costs in your target neighborhood

- Add a 10–15% buffer to cover unexpected expenses

- Open separate savings accounts for closing costs, repairs, and furniture

- Work with professionals like a financial advisor or your real estate agent to estimate expenses accurately

Account for Landscaping and Exterior Upgrades

Outdoor upkeep can catch new homeowners off guard. Whether it’s lawn care, tree trimming, gutter cleaning, or driveway maintenance, exterior costs can add up quickly, especially in Central Virginia homes with larger yards or mature trees.

Budget tip: Set aside funds for seasonal yard care and basic tools like a lawn mower, rake, or leaf blower. If you’re buying in a neighborhood with strict curb appeal standards or an HOA, check whether certain exterior improvements are required.

Consider Ongoing Appliance Replacement Costs

Most major appliances have a lifespan of 8 to 15 years. If you’re purchasing a home with older appliances — which is common in Charlottesville’s historic homes — you may need to budget for replacements sooner than expected.

Budget tip: Review the age and condition of appliances during the inspection period to ensure they are in good working order. Prioritize replacements based on energy efficiency and necessity (e.g., water heater, HVAC).

Ready to Buy with Confidence? Let Matthias John Realty Help

Buying a home isn’t just about the listing price — it’s about being fully prepared for every cost that comes with it. I help first-time homebuyers in Charlottesville and the surrounding Albemarle County areas understand the full financial picture, avoid surprises, and make informed decisions with confidence.

From budgeting for closing costs to navigating HOA fees and comparing insurance premiums, I’ll guide you through every step of the process. Call a local real estate agent at (434) 906-4630 or complete a contact form to schedule your free consultation today. Let’s make your first home a smart, sustainable investment.

Frequently Asked Questions (FAQ)

What are the most common hidden costs of buying a home?

Common hidden costs include closing costs, moving expenses, home maintenance, increased utility bills, HOA fees, and property tax increases.

How much should I save beyond the down payment?

Aim to save at least 3–5% of the home’s value for closing and immediate expenses, plus another 1–3% annually for ongoing maintenance.

Can I negotiate closing costs?

Yes, some closing costs, like origination fees or title charges, may be negotiable. Sellers may also offer concessions depending on the market.

Should I get a home warranty?

Home warranties can be helpful, especially for older homes. They often cover major appliances and systems, offering peace of mind during the first year.

Is there financial assistance for first-time homebuyers in Virginia?

Yes, Virginia offers several assistance programs for eligible buyers. Options include Virginia Housing (formerly VHDA) loans, down payment assistance grants, and mortgage credit certificates (MCCs) that reduce your tax burden. A local lender or real estate agent can walk you through available programs and help you determine your eligibility.

What costs increase after closing that most buyers aren’t expecting?

Property taxes often increase post-sale, especially if the home was under-assessed previously. Utility bills, especially for larger or older homes, may be higher than expected. Insurance premiums can also rise depending on your coverage selections. Many first-time buyers also underestimate the cost of furnishing a home and addressing minor repairs within the first year.

How do I know if a home’s utility costs will be high?

Request past utility bills from the seller to see seasonal fluctuations. Older homes in Charlottesville may have single-pane windows, outdated HVAC systems, or lack insulation — all of which can lead to higher bills. You can also ask your inspector or utility provider about average costs for homes of similar size and age.

Matthias John is a licensed REALTOR® serving Central Virginia since 2014. With dual Master’s degrees in Public Policy & Governance and Political Science & Linguistics, he brings analytical expertise to every real estate transaction.

Originally from Germany and multilingual, Matthias combines international perspective with deep local knowledge of the Charlottesville market. His background in public policy and sales enables him to navigate complex negotiations and regulatory requirements with precision.

Matthias specializes in helping both first-time homebuyers and property investors find opportunities that match their specific needs. His data-driven approach and commitment to transparent communication have earned him recognition among clients for his integrity and thoroughness.

As a longtime resident of Central Virginia, Matthias leverages his community connections and market insights to create customized marketing strategies for sellers and targeted property searches for buyers.

Member: National Association of REALTORS®, Virginia Association of REALTORS®